For many months in between client projects, I’ve been working on this puzzle game and it’s finally live. Turny Tracks takes a twist on the classic pipe connecting puzzle game, where you guide a train along the tracks to reach the daily goals, or vie for the “longest train”.

Loan-U-Later is now an Android app!

It took me some time to fit it in, but I have finally rebuilt Loan-U-Later as a Unity app, and the Android build is now available on Google Play.

Unity for a UI based utility app, what is this lunacy, you say? In the past, I’ve used Unity’s UI for simple menus and gameplay UI, but stayed away from more complex layouts, so I wanted to see what Unity’s UI could do and am decently happy with it. There are some drawbacks, though.

Probably the most significant one is that the UI is entirely part of Unity’s graphics engine, and very rarely uses native UI elements, so any services or functionalities that the OS provides for free with native UI are not available. One such example is accessibility; Unity’ UI does not support native accessibility functions, TalkBack for Android and VoiceOver for iOS, so they just don’t work – there is a plugin available to mimic this, but I have yet to implement it. For some other functionalities, such as alerts, I utilized the great asset Cross Platform Native Plugins.

Another hurdle was the limited options of include UI elements. I ended up either having build my own, or modify included or 3rd party elements to fit my needs. Some examples of this are the tab and table views. Due to the nature of this app, I was able to avoid the issues related to interacting with the native keyboard.

Anyway, there is a bit of backwards compatibility to handle before I can update the iOS version, but it will be coming in the near future. Enjoy!

Loan-U-Later has been updated!

This was almost literally the least I could do to get it up and running for iOS 11. I probably wouldn’t have done it, but I got a few emails asking if I was going to, so I hammered it out. I actually started a significant rebuild, but ran out of time before the OS release, so I had to do this quick and dirty update. Hopefully I will find some time soon to finish the true rebuild.

Loan-U-Later on the iOS App Store

2012 Voter’s Guide: Oregon State Measures

Following are my suggestions for the state measures.

77 – disaster authority: YES

From the legislature. This measure solidifies in to the state constitution that which is already law, the governor’s ability to declare a disaster. Additionally, it gives the governor the ability to transfer money from certain funds to pay for disaster response and recovery. To counter this authority being abused, the legislature will convene within 30 days to pass law as to what action to take. Sounds reasonable to me.

78 – constitutional text tidying: YES

From the legislature. This measure tidies up some text in the constitution. Just vote Yes.

79 – real estate transfer tax prohibition: NO

This measure makes it unconstitutional for a local government (state, county, or city) to impose any new taxes or fees on transferring real estate interests. What does that mean? Well, nothing really as it is already against the law, but by writing it in to the constitution means that should we as a people or the legislature decide a transfer tax/fee is needed, it would require amending the constitution again to allow it.

80 – legalize marijuana: YES

It’s time to be adults and admit the prohibition on marijuana is going to end, it’s just a matter of time. Many states already have medical exemptions, and several others have measures this election to legalize it. The sooner we start the legalization process, the sooner we can start regulating, standardizing, and taxing it. Yes, some people will grow there own (they already do), but as it becomes cheaper to buy than grow, those who choose to use, will buy it instead. As a comparison, it is legal to grow your own tobacco, but no one does. As for marijuana being a gateway drug, it’s no more of one than alcohol, tobacco, pain pills, and a plethora of other legal drugs, which are just as if not more harmful. Finally, if this measure does pass, it will most likely end up in the Supreme Court as a they will have to decide whether the legality of marijuana is the federal or state’s right to set.

81 – gill net fishing ban: NO

I’ll admit that all I know about this topic is what I’ve read in the Voter’s Guide and a brief description from http://www.montereybayaquarium.org/cr/cr_seafoodwatch/sfw_gear.aspx

, but here is what took away from it. Gill nets are already illegal on all inline waters except for the Columbia, and while these types of nets are known for unintentionally catching other sea life than what the fishers are supposed to catch, such as wild salmon instead of hatchery salmon, but so do other forms of fishing. By banning gill nets to Oregon fishers, this could likely end Oregon commercial fishing on the Columbia as Washington fishers can still use them. While we should work to ban all gill net fishing on the Columbia, we should work with Washington to ban it together, or we aren’t really helping the environment at all, just hurting our economy.

82 / 83 – private casinos: NO

I’m not a big gambler, but I have no issue with casinos. They take money from those who are willing to part with it even if they can’t afford it. What those casinos do with the money is more of what is at stake. While tribal casinos give back less to the state than the proposed private casino would, the tribal casinos mainly use the profits for the betterment of their community, which in turn helps us out be being less of a strain on our resources, whereas a private casino, well we don’t know what a private casino will do with it, but most likely take it out of the state and put it in the coffers of their share holders.

84 – estate tax phase out: NO

We live in a country that allows some people to amass great wealth, usually on the backs of others. The estate tax (or “death tax” for those who wish)

is a way of spreading some of that wealth around after that person passes. The current Oregon estate tax is levied again those people who’s estates are over 1 Million dollars, but not on that first million, so at least that much can go to their heirs untouched. The rest is taxed on a sliding scale. By doing away with the estate tax, the state government will lose vital funds used to provide services to all Oregonian, and while 1 million dollars may seem a little low by today’s standards, doing away with it entirely will harm many more than it will benefit.

85 – kicker funds to schools: NO

I really want to say YES to this one, but it’s not a good plan. The kicker fund is inconsistent because it’s what is left over if the state under-estimates how much money it needs from corporate taxes, which can be $0. We need to fund out schools with consistent amounts so that they can budget regularly, not throw a handful of money at them one moment and none the next.

After more than a year, IKEA finally restocked a specific model of sofa-bed that we’ve been waiting for. I purchased it in November and it took me another 4 months to finally make a trip to Fernhaven. On Presidents Day, Peggy and I rented a trailer, hauled the boxes out there, and put it together. Now Fernhaven’s loft is complete.

Supermajority? ha.

On OPB this morning I heard a story that said the Senate Democrats are losing their “supermajority”, the filibuster-proof 60 votes, because of Republican Scott Brown’s election in Massachusetts this week. Supermajority? Who are they kidding? The Democratic Party is so fractured as to make it impotent. With progressives on one side and “Blue Dogs” on the other of nearly every major issue – abortion, health care, gay marriage, gun control, immigration – it’s no surprise that one year after the “Democratic Takeover” nothing has happened. Too bad the Democrats can’t agree on ANYTHING, or we might actually see some of this “Change” that Obama promised. At least the Republicans got things done with their “tow the line or you’re out” mentality.

Oregon January 2010 Special Election

If your a registered voter in Oregon, you should have received your Voter’s Pamphlet for the special election we’re having in a few weeks on a pair of tax measures submitted by the state legislature. If passed, these measures will add to the General Fund, which in turn pays for education, health care, public safety, and other state provided services.

Measure 66: Tax increase on households earning over $125,000 (single filers) or $250,000 (joint filers)

Basically, this measure creates extra tax brackets for earners over $125,000 and raises taxes for those people. The tax rate is higher for the first 3 years, and then lowers a bit in 2012.

My View: While this tax affects a few S-Corporations (businesses whose profits pass directly to the owner), most affected by this tax are wealthy individuals, who can afford to give back to the community that helped make them wealthy.

VOTE: YES

Measure 67: Increase business minimum tax and profits tax, and expand list of businesses required to pay. Increases filing fees.

Currently, some businesses pay a profits tax of 6.6%, but if that is below $10, they pay $10. This measure increases the profits tax to 7.9% for income over $250,000 (which changes in 2013) and changes the minimum tax to a bracketed sliding value based on revenue, from $150 (revenue under $500,000) to $100,000 (revenue over $100,000,000). Generally speaking, it’s about 0.1%. In addition, partnerships, S-Corps, and LLCs will be required to pay the minimum tax.

My View: I’ve emphasized a few words above, profits and revenue. Profit is income minus business expenses (including paying employees) where as revenue is just income. The new minimum tax is based on what a business takes in regardless of what they pay out in expenses. For example, if a business does $2 MILLION in sales and has $2 MILLION in overhead (employees, rent, merchandise, etc.), it has profits of $0. They would have to pay $1500, which is the minimum tax based on revenue. To meet this they will have to either reduce spending, either by cutting benefits, wages/salaries, or workers, or increase prices.

On a different note, while the amount in comparison seems trivial, that can add up over a business’s supply chain. An example is a grocery store who buys bread from a bakery who buys flour from a mill who buys wheat from a farmer who buys fertilizer and seed, etc. This “sales tax” will either increase the cost to consumer or encourage conglomerations, cutting out the smaller businesses.

In the end this is a sales tax and a sales tax is the “third leg” of taxation that Oregon has fought against for many years, but desperately needs. Personally, I don’t like the price changing at the register, so this type of sales tax, where the tax will be built in to the price the consumer pays, is one that I can get behind.

VOTE: YES

MacBook Pro to USB trackpad

Over the years I’ve become a fan of the trackpad, especially since the introduction multitouch and gestures. The problem is that I mainly use an iMac, and there are very few, if any, options for a USB trackpad that works as well on a Mac as the built in trackpad works. In scrounging the interwebbernets for the mythical USB multitouch trackpad, I came across a few references to using a MacBook’s trackpad since it is USB based. This went by the wayside for a while, then recently I stumbled upon a post that went in to some detail of modding a trackpad for use as a USB device, and after seeing that I could buy the MacBook Pro’s trackpad case part on eBay for $30, I figured I’d give it a go.

Following are the photos of the process and some commentary.

Soldering the lead wires:

Looking at the small ribbon connecting to the controller board, I noticed that it only had four leads. Since this is how many wires are in a USB cable, I made some assumptions about which leads were associated to which USB functions, namely that the left one that connected to ground, the right one to power, and the other two were the data cables. Since there was no way that I could solder to the leads themselves since they were so small, I needed to find which test points (the gold spots on the board) connected to which lead. I used a combination of tracing the circuit board and guessing to find the match, then used a digital multimeter to verify my guess. Once found them all, it was time to solder. Since I did not know for sure which of these leads connected to which USB function, I decided to solder lead wires instead of directly to the USB cable. I prepped some multi-colored wire and fired up the soldering iron. I was using an iron with a small tip, but even smaller would have been better. I have seen reference to a “needle tip” which probably would have been just right. I melted the solder onto the lead wire, then used the iron to melt that on to the board. Several times I had to unsolder a wire because it was touching multiple test points. Suffice it to say that it was a nerve racking ordeal. Next, I twisted and taped the lead wires to the USB cable’s wires, having to guess which data wire went to which lead. Luckily enough, I guessed correctly the first time, because when I plugged it in to my keyboard, it just work. It shows up in System Profiler as “Apple Internal Keyboard / Trackpad” and I can use the default trackpad preference pane to set the gesture functionality I want.

Cutting and folding the case:

To get this to a usable state, I knew that I’d have to cut the case down to size. My plan was to use tin snips and a sheet metal bender to form the metal in to a nice little case (photos 9 and 10, and redesign at 11), but I quickly ran into problems. When cutting, the tin snips were curling the metal, so I had to cut at an angle so that the excess case got curled, and not the track pad itself. After a few tests, I was able to get this down, and snipped out the trackpad with little damage. I wish I could say the same for folding the edges. The sheet metal bender was too large and I had no way to keep the rest of the trackpad from flexing when trying to bend it. I reverted to slowly bending bit by bit with pliers, but in the end, I bent the trackpad enough that the button only works when pushed firmly in the center.

Conclusion:

I’ve now been using my trackpad for several days now instead of a mouse, am still getting use to it, but I think it’s going to stick. I wish that I could customize what the gestures do, but for now will have to be satisfied with having them at all. If you are considering making one of these, my number one suggestion is that unless you know what you are doing, DO NOT FOLD. Cut the case and use a Dremel or something to smooth the edges, and use something else, even metal from the excess case, to support it. This is my only regret since the button is not wonky. My second suggestion is get a small soldering iron tip, it will just make life that much easier.

AgentWorx by AppSpice.com

Just released! AgentWorx by AppSpice.com.![]() Why am I telling you about it here? Because I coded it. AppSpice.com is the client that commissioned the app that I’ve been working with for several months now. I’m pretty proud of this app so check it out. For anyone who may not find this useful as it is designed for realtors, there is a free version on iTunes.

Why am I telling you about it here? Because I coded it. AppSpice.com is the client that commissioned the app that I’ve been working with for several months now. I’m pretty proud of this app so check it out. For anyone who may not find this useful as it is designed for realtors, there is a free version on iTunes.

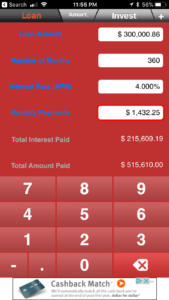

Loan-U-Later 1.2.0

![]() Loan-U-Later is a loan (such as mortgage) and investment calculator that can calculate many aspect of a loan or investment, including the interest rate, and total interest paid or total contribution made. Loan-U-Later also features an amortization table for the currently calculation.

Loan-U-Later is a loan (such as mortgage) and investment calculator that can calculate many aspect of a loan or investment, including the interest rate, and total interest paid or total contribution made. Loan-U-Later also features an amortization table for the currently calculation.

New features in version 1.2.0:

- Change interface to tabbed style.

- Added Setting to disable rotating background color.

- New icon.

- Now compatible with iPhone OS 2.1

Loan-U-Later is available on the iTunes App Store

Loan-U-Later’s support forum